Most Rye residents are not opposed to better wireless coverage however, upon review of many of the statements made by proponents of the Rye/Crown-Castle cellphone antennae project, it is abundantly clear that an effort needs to be made to separate fact from fiction.

What We’ve Heard: “Crown Castle’s pole-mounted cell phone antennas do not reduce property values”

The Facts: A recent Google Consumer Survey conducted in the Northeast shows most respondents would pay 6 percent to 10 percent less for a home located near a pole-mounted cell phone antennae. (Source: Google Consumer survey, 500 respondents, Northeast US, 9/9/16 – 9/13/16)

What We’ve Heard: “Realtors don’t think antennas affect property values”

The Facts: According the National Association of Realtors, an overwhelming 94 percent of home buyers and renters say they are less interested and would pay less for a property located near a cell tower or antenna. Furthermore, of the 1,000 survey respondents, 79 percent said that under no circumstances would they ever purchase or rent a property within a few blocks of a cell tower or antenna, and almost 90 percent said they were concerned about the increasing number of cell towers and antennas in their residential neighborhood. (Source: http://realtormag.realtor.org/daily-news/2014/07/25/cell-towers-antennas-problematic-for-buyers)

What we’ve heard: “The Crown Castle antennas aren’t a home buyer negotiating point.”

The Facts: Smart home buyers will use antenna perception as a negotiating point to reduce the price they pay for a new home in Rye.

What we’ve heard: “The Rye Crown Castle antenna project is not a fifth amendment issue”

The Facts: The Rye antenna project is a government taking. Many property owners in Rye are having their property values lowered without due process of law. This violates the fifth amendment.

What we’ve heard: “Antennas are safe and therefore they will not reduce property values”

The Facts: There is continued debate about the health effects of antennas, which is, in turn, driving public perception that cell phone antennas may be a health risk. Perception is what affects property values. Furthermore, recent studies from reputable sources are reigniting the debate about the health risks of cell phone antennas. For example, a major new cell phone radiation study links radio-frequency radiation to tumor formation in rats. (Source: Scientific American, May 27, 2016). The National Institute of Health stated, “the available literature cannot rule out adverse health effects of RFR due to the impossibility to prove a non-effect and due to the remaining knowledge gaps.” (Source: http://www.ncbi.nlm.nih.gov/pmc/articles/PMC3599119/)

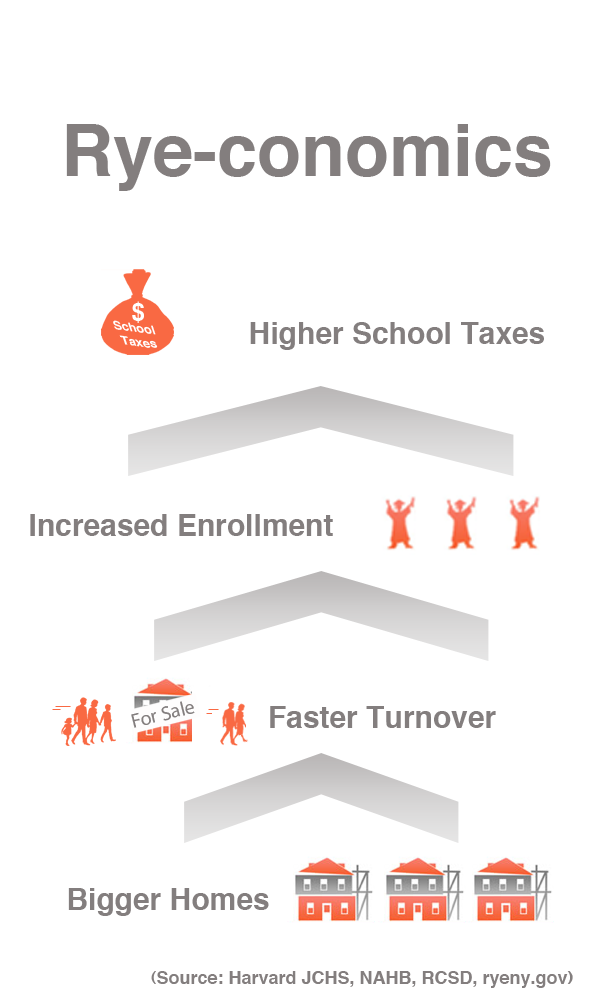

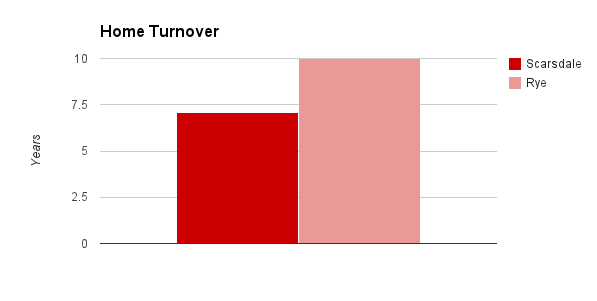

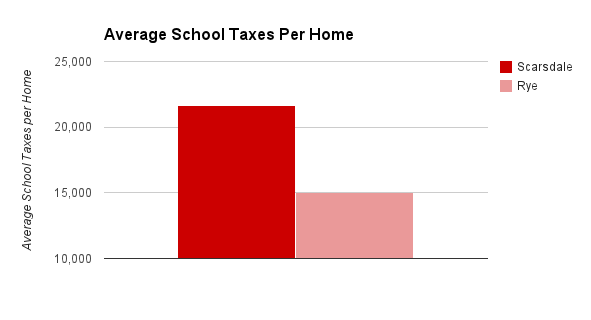

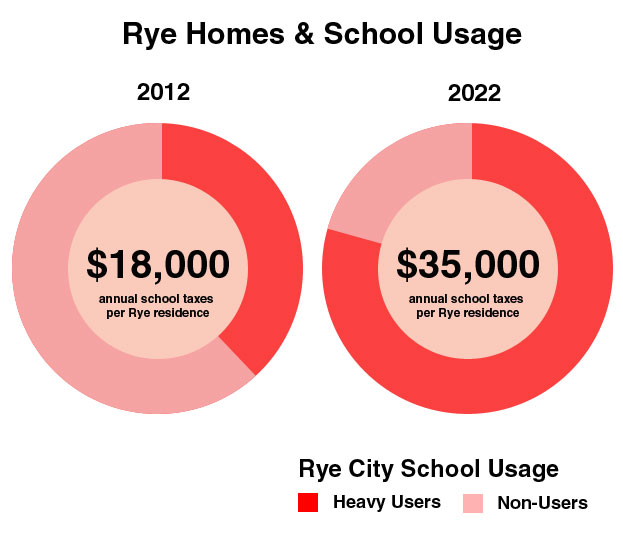

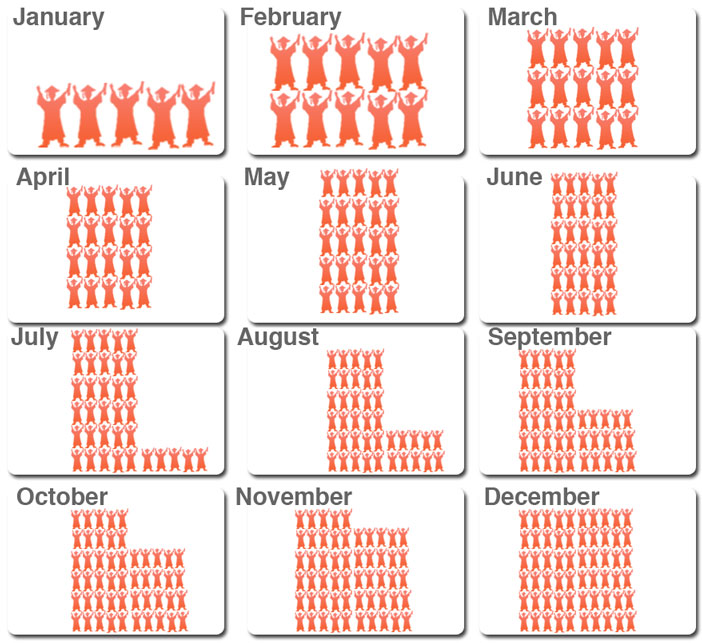

What we’ve heard: “Antennas will not affect City of Rye property tax revenue.”

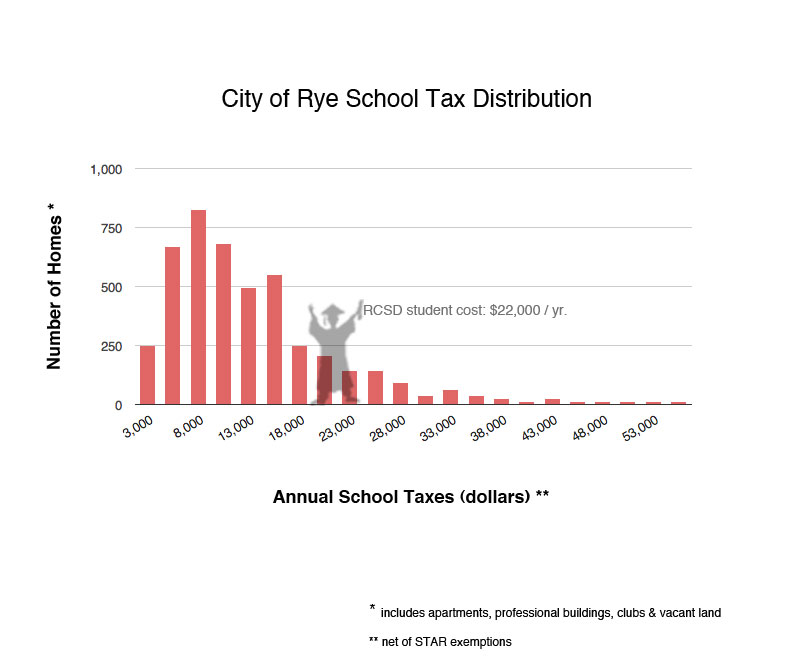

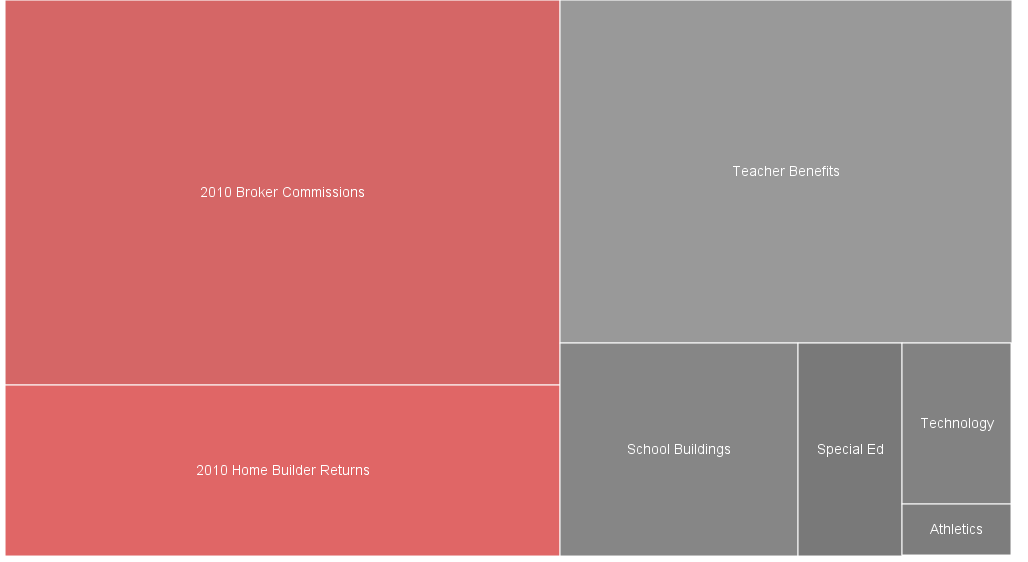

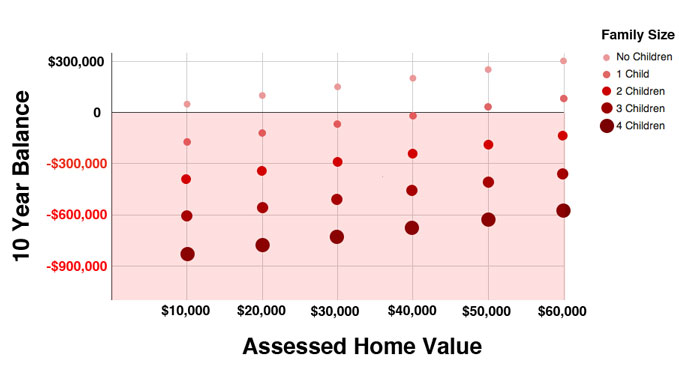

Facts: Tax certiorari lawyers representing property owners will leverage cell phone antenna property value data to achieve significant tax assessment reductions through assessor negotiations, the grievance process and litigation. The estimated present value of lost real estate taxes for each antenna is $60,000 – $80,000. The present value of fifty antennas would represent $3 million – $4 million in lost tax revenue for the City of Rye (assumes $20,000 average annual property taxes per affected home).

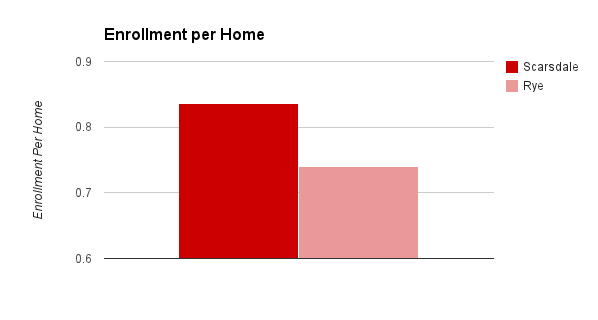

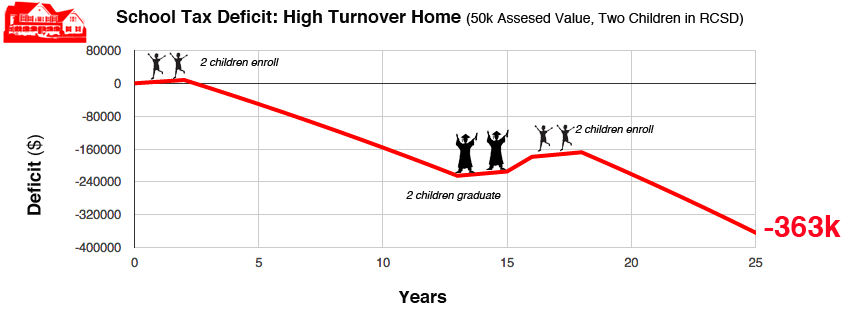

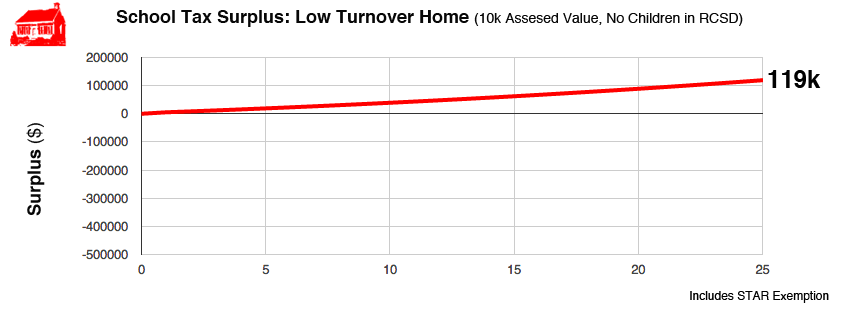

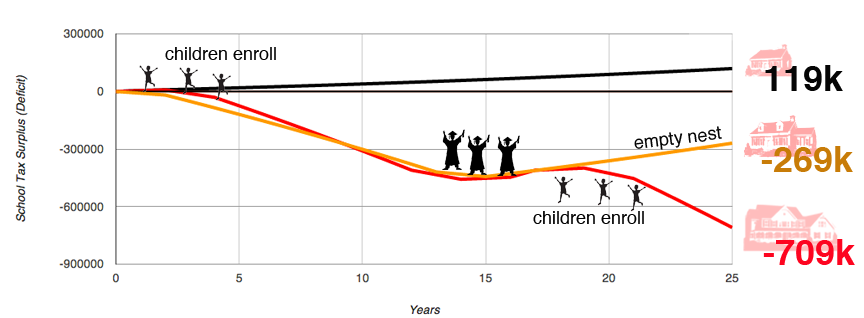

What We’ve Heard: “Crown Castle antennas wont affect the school budget.”

The Facts: Antennas reduce property values and therefore reduce school tax revenue.

What We’ve Heard: “Rye’s zoning does not address the kind of antennas and cabinets Crown Castle intends to install.”

The Facts: Rye’s zoning does cover antennas proposed by Crown Castle. Rye City Code Chapter 196, Wireless Telecommunications Facilities specifically addresses wireless transmission equipment, and cabinets. (Source: http://ecode360.com/6976885)

What We’ve Heard: “As long as the buyer doesn’t notice the antenna, it wont affect sales price”

The Facts: Hiding antennas may trick unsuspecting buyers to pay more than a home is worth but it doesn’t change the fact that cell phone antennas negatively affect home value.

What We’ve Heard: “A Rye home may have sold for a reasonable price, even though it was located near an antenna.”

The Facts: This is anecdotal and proves nothing. Many non-representative real estate transactions occur as the result of buyers acting imprudently and without complete knowledge about hidden defects and property value issues.

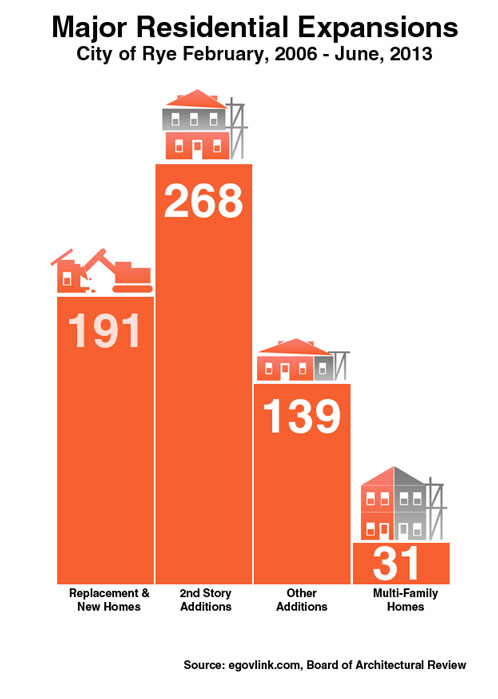

What We’ve Heard: “A precedent was set. It’s too late to change.”

The Facts: While it’s true a handful of pole-mounted antennas exist in Rye, two wrongs don’t make a right. The pre-existing antennas were installed quietly without ample consideration of the facts, the law and other matters.

What We’ve Heard: “As long as there are some buyers who don’t care about antennas, property values wont be affected.”

The Facts: Even buyers who don’t care about antennas will likely use antenna proximity to negotiate a lower price. Property value is a function of supply and demand. Antennas reduce demand and therefore property value.