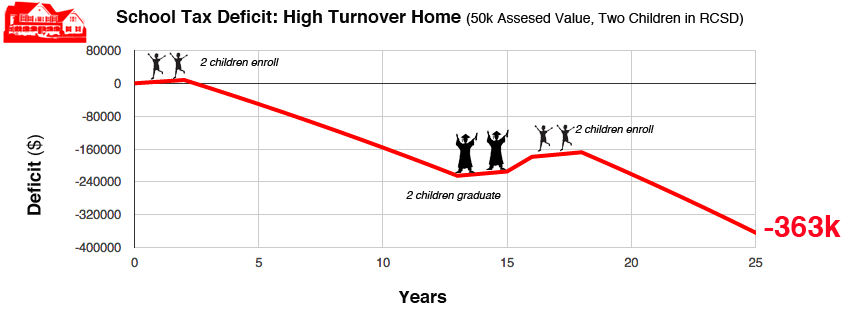

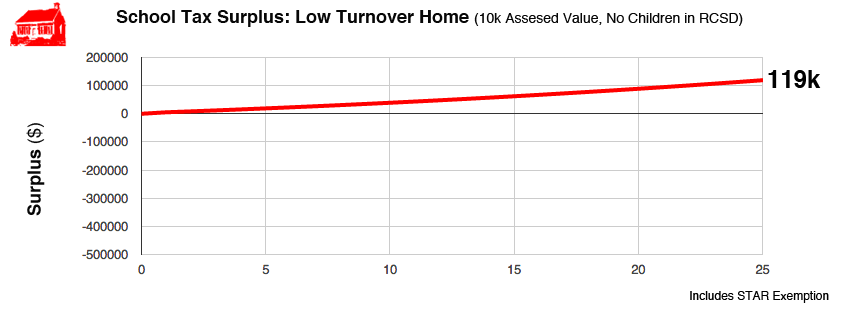

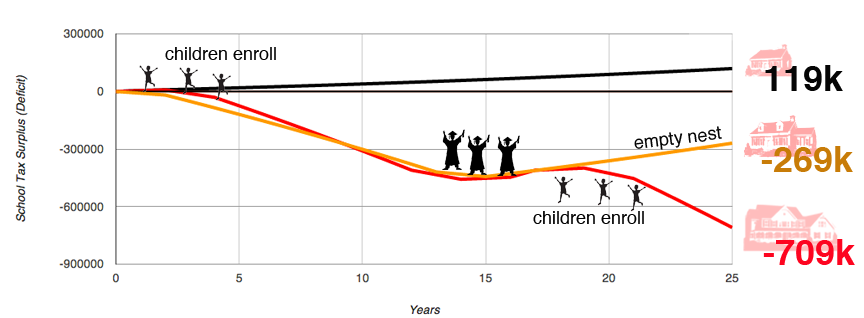

Only a small percentage of households in Rye pay enough school taxes to cover the cost of two children in the RCSD. Even most large new homes do not pay enough taxes to pay for two students. The gap is the school tax deficit.

While it’s true, higher assessments on large new homes provide more school tax revenue, there’s reason to believe high assessments may also increase turnover and that this, in turn, creates a larger school tax deficit. In the case study below, a large home assessed at $50,000 has more than double the cumulative school tax deficit of a smaller home assessed at $25,000. A more detailed analysis is here.

An updated City Plan and more research is required to better understand the important relationship between home size, assessment, turnover and school tax deficits.

Assumptions:

- Cost per Student: $22,460/year

- School Tax Rate: 529.68 per $1,000 of assessed value

- Inflation: 2%

- Children Age Difference: 2 years