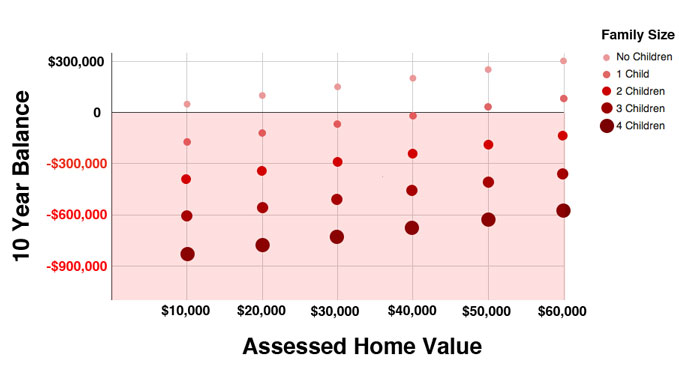

For many households, there’s a gap between school-taxes and the cost of educating children enrolled in the Rye public schools. The difference depends on the home’s assessed value and the number of school-age children enrolled in public school.

The following graph shows the “ten year balance” per household based on the number of children enrolled in Rye Public schools and home assessment value. The ten year balance is the total amount of educational expenses incurred minus total school taxes paid during the same period.

For example, over ten years, two children enrolled in public school and living in a home assessed at thirty thousand dollars, will incur approximately $288,000 in educational expenses, net of school taxes paid. Put another way, it takes 2.8 no-child households assessed at twenty-thousand dollars to offset the unfunded education expenses (cost of education – school taxes paid) of one two-child household assessed at thirty-thousand dollars.

(Source: ryeny.gov; Rye Board of Education. Assumes school tax mil rate of .5073 and $22,000/student per year for education; does not include future inflation. For comparative purposes, households with school-age children attending private schools are equivalent to households with no-school age children)