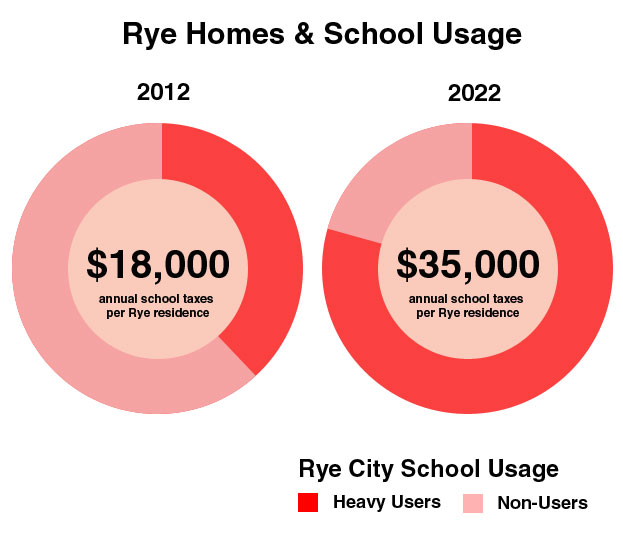

Rye school taxes (average $18,000 per residence) are comparable to other locations in Westchester, but that could change if the current trend in residential expansion continues. The graph above shows about forty percent of residences located in the RCSD (about 1,500 homes) accommodate heavy users of Rye City Schools; in ten years this is may jump to eighty percent (about 3,000 homes) leading to average taxes of $35,000 per year.

While a reasonable amount of housing-stock turnover is desirable, there are good reasons to update the Rye Development Plan and take steps to create a balance between households that are heavy users of the Rye City schools and households that are not. There are currently hundreds of cottages and ranch homes (possibly well-suited to empty nesters) poised to be torn down and converted to homes for heavy school users.

Here’s the math:

- 4,238 Non Rye-Neck Residences, 11% private school enrollment, 80% heavy users, 2.5 children per residence

- 7,543 enrollment/144 classes = 52 students per class (school expansion required to maintain current class size)

- $20,000 taxes per school child * 7,543 future enrollment / 4,238 total homes = $35,600 school taxes per home